May 11, 2016

Back Story: Gimme Shelter

The Seattle House and Resource Effort (SHARE) gets around a million dollars in government grants and in-kind donations each year. They ostensibly use this money to shelter homeless people, which they do through a network of small indoor shelters and larger homeless encampments. On it’s Web site, SHARE claims that “up to 450 people each night find safety, shelter, dignity, and respect in our 14 self-managed shelters and 2 Tent Cities.” Although the group is the subject of frequent scandals around its homeless camps, taxpayer money keeps flowing in because most of the government money is tied to indoor shelters and not the camps and because there is a general perception within government that SHARE is doing what other shelters can’t. SHARE provides the City of Seattle with hundreds of shelter beds at a per-bed rate of less than $7 per night, which is considerably cheaper than the rate for other providers. SHARE also runs a winter shelter program to bring large groups of people in off the streets during extreme weather. Records are not kept for individual winter shelter stays, so the money for those is budgeted by the shelter night rather than the bed night. That throws SHARE’s $7-a-night figure into question, because that number is based on regular shelter beds, and much of SHARE’s costs for those are defrayed by the local churches who are supplying the space and beds, and charging SHARE only for utilities. In the case of the church beds, the cost to the taxpayer may indeed be $7 a night. Or even less. But that is to the credit of the donor churches, not SHARE.

Christmas at SHARE’s Nickelsville homeless camp, 2013 ~ Photo by Kevin R. McClintic

It’s even harder to know what the real bed-night rate works out to, when you consider that SHARE’s claim about how many people it serves is not subject to meaningful scrutiny. Seattle officials don’t verify SHARE’s reported number; they just take it on faith. The same is true for SHARE’s shelter operating costs. If SHARE says it pays a certain amount for utilities – or transportation, or postage stamps – the City accepts that. The group’s financial officers, such as they are, do not respond to questions on their financials. I know that because I’ve tried asking them questions about specific items on their tax returns and about certain claims they’ve made to news reporters about costs. –Nada.

Enter, The Accountant

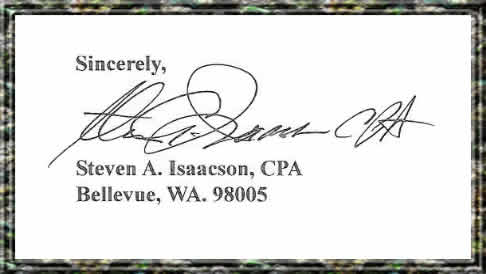

Seattle’s Human Services Department (HSD) recently provided one of my colleagues with some of SHARE’s recent financial statements. The documents came with a cover letter [click here to see it] signed by one Steven A. Isaacson, who identifies himself as a Bellevue accountant. In his letter, Mr. Isaacson says he has made inquiries of SHARE personnel and has reviewed “analytical procedures applied to [their attached] financial data” and found that everything is in conformity with generally accepted accounting procedures. He is careful to distinguish a review from an audit – which he did not do – and he notes that all the financial information provided by SHARE is the “representation of SHARE’s management” and not his own. It is, in short, a guarded approval for SHARE’s books.

Seattle’s Human Services Department (HSD) recently provided one of my colleagues with some of SHARE’s recent financial statements. The documents came with a cover letter [click here to see it] signed by one Steven A. Isaacson, who identifies himself as a Bellevue accountant. In his letter, Mr. Isaacson says he has made inquiries of SHARE personnel and has reviewed “analytical procedures applied to [their attached] financial data” and found that everything is in conformity with generally accepted accounting procedures. He is careful to distinguish a review from an audit – which he did not do – and he notes that all the financial information provided by SHARE is the “representation of SHARE’s management” and not his own. It is, in short, a guarded approval for SHARE’s books.

Considering the questionable nature of SHARE’s financial doings, a full audit of the books is overdue, but the fact that Mr. Isaacson merely did a review and not an audit is not the chief problem here. The chief problem is that he was not even qualified to do a review, since he was not, in fact, a Certified Public Accountant, as he claims in the cover. And has not been one for 32 years.

How do I know that? Because along with one of his cover letters, Mr. Isaacson attached a business card, and, on a whim, I e-mailed a link to one of my SHARE blog posts to the address he lists (s.isaacson@hotmail.com). It bounced back: No such address.

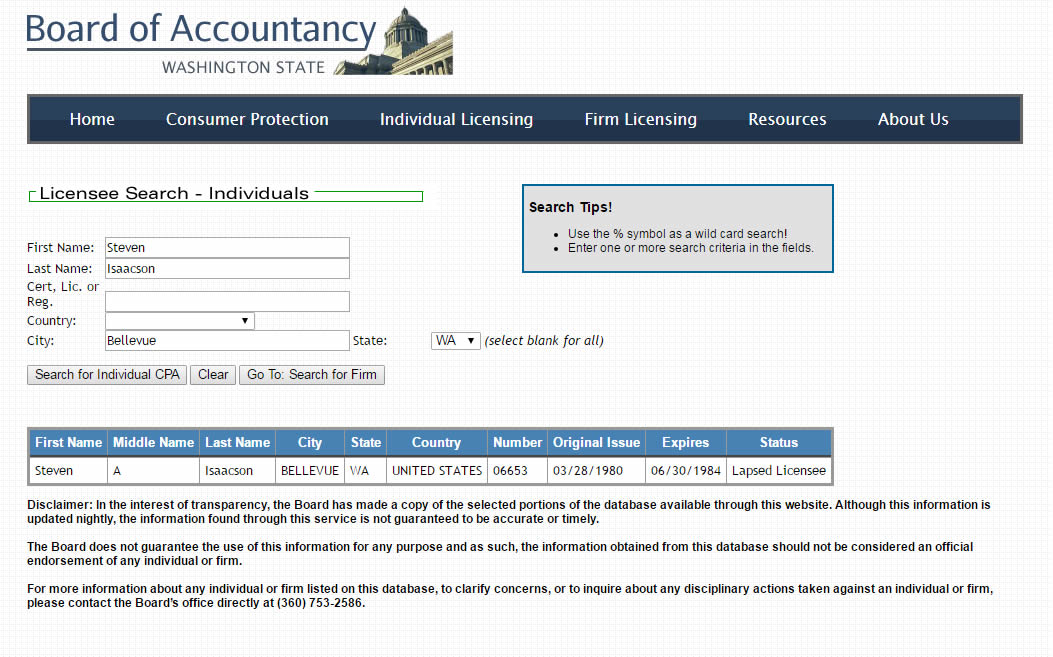

When the e-mail came back undeliverable, I did a Google search and it turned up nothing on Mr. Isaacson. So then I went to the Washington State Board of Accountancy’s Web site and did an online credential search. That search showed that a Steven A. Isaacson had been a licensed CPA from 1980 to 1984, but when that license lapsed 1984, he did not renew it. [Click on the graphic below to enlarge it.]

A quick check of the Bellevue phone directories did not show a listing for a Mr. Steven A. Isaacson as an accountant either. Nor does he have an accounting business licensed in Bellevue or any other part of Washington state. Nor is he currently a member of an accounting firm. The business address he gave on his letterhead and card is for a condominium that he does not own and possibly does not even occupy.

At that point I thought Mr. Isaacson might be an altogether fictional person, but a court records check put that to rest. It still seemed too fantastic, the idea of an organization that does big business with the city making a rookie move as stupid as this. I wondered: Can a person can still call himself a CPA or somehow work for clients after his license has lapsed? But I checked it out, and the answer is no on both counts. According to the nationwide CPA Verify site, the “individual cannot use the [CPA] title or engage in the practice of public accounting until the credential is reinstated.” [See CPA Verify report on Steven A. Isaacson here.] As far as the term “public accounting” goes, we can assume that anyone who submits a review of a large 501(c)3 non-profit corporation to a government agency and attaches a business card identifying himself as a CPA . . . is engaged in “public accounting” – something which Mr. Isaacson is not allowed to do by law.

In looking further through the documents I got from the City, I noticed that Mr. Isaacson’s name is on several. I’m sure there are more in the City’s possession, but here are the ones I have. Click on the titles to view them:

In looking further through the documents I got from the City, I noticed that Mr. Isaacson’s name is on several. I’m sure there are more in the City’s possession, but here are the ones I have. Click on the titles to view them:

- 2013-2014 SHARE Financial Statements and Review Report (draft)

- 2012-2013 SHARE Financial Statements and Report

- 2009-2010 SHARE Financial Statements and Report (Draft)

- 2008-2009 SHARE Financial Statements and Report

- 2015 IRS Form 990 (for tax year 2014)

On cover letters attached to these documents, Mr. Isaacson calls himself a CPA. On the first four, he says that he is including an “independent accountant’s review report” with himself as the accountant. The most recent letter is dated August 10, 2015, which means that as recently as nine months ago, Isaacson was billing himself as a CPA to a government agency – or two government agencies if you include the IRS. Interestingly, on this copy of the 990 form Isaacson has not signed with “CPA” and the form was not signed by any officer of SHARE, though on the copy that was eventually filed, a Lantz Rowland signed for SHARE. Mr. Rowland’s job at SHARE is not identified anywhere on 990 form itself. All we have for him, and all the other corporate officers, is a PO Box address.

I’ve seen Mr. Rowland at public meetings. He seemed befuddled, distant. Given that he lives in a tent, he was probably not the best person to vouch for the accuracy of a tax return dealing with $800k in cash flow. Still, Mr. Rowland does get around, in a manner of speaking. Here’s a picture of him from a December 2015 article in the Irish Times:

Photo: Shannon Stapletom / Reuters

(The full article is here.)

Speaking of financial competence, I looked into Mr. Isaacson’s court record and found some interesting items. For liability reasons, I can’t get specific about what I found. However, I can offer an opinion that Mr. Isaacson’s record is not consistent with the habits of a good money manager.

Before posting this story, I contacted Catherine Lester, director of the Seattle Human Services Department (HSD). HSD is the agency that manages contracts with SHARE. I asked her why SHARE had submitted these “independent account reviews” in the first place. Several days later, I got a response from public relations specialist Chelsea Kellogg, who said:

Any agency applying for funding is asked to provide a copy of the agency’s current fiscal year’s financial statements reports, consisting of the Balance Sheet, Income Statement and Statement of Cash Flows, certified by the agency’s CFO, Finance Officer, or Board Treasurer.

From this I would say that Mr. Isaacson has presumably been acting in the role of “CFO, Finance Officer, or Board Treasurer” for SHARE. I asked Ms. Kellogg if I had that right, but she did not respond.

Why would SHARE hire an accountant who wasn’t there?

The Seattle area is crawling with accountants. If you go to the Yellow Pages, you’ll find hundreds of them. Presumably most or all of them are current with their CPA licenses. If any of them do have a lapsed CPA license, surely it wouldn’t be 32 years out of date. It’s a fair guess that many of these accountants will do pro bono work for any group that helps homeless people. –So why? Why would SHARE pass over a list of legitimate accountants who would work for cheap or free . . . and go with an obscure imposter?

Could it be that SHARE has something on the books that they don’t want a legitimate accountant to see?

–Story by David Preston. Additional research by Karen Morris and Janice Richardson

Image credits (in order): Rene Magritte: “Not to be reproduced” (1937), “The Son of Man” (1946)

Postscript

HSD says nothing’s rotten in Denmark

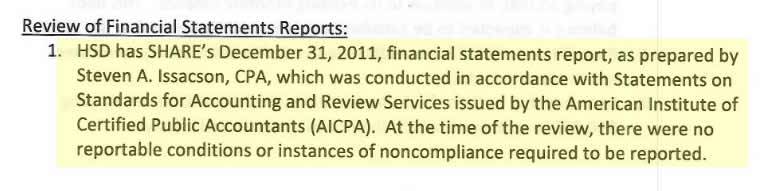

The Seattle Human Services Department is rather more trusting than me when it comes to SHARE’s financials. On October 20, 2015, HSD fiscal auditor Efren Agmata sat down with four SHARE staffers for a fiscal review, following which, Mr. Agmata and Jason Johnson (a deputy director of HSD) gave SHARE a clean bill of health. See HSD’s fiscal review summary here.

Neither Mr. Rowland, who signed SHARE’s 2014 tax form, nor Mr. Isaacson were at the fiscal review. As HSD’s follow-up letter to SHARE shows, Mr. Agmata and Mr. Johnson not only accepted SHARE’s claim that Mr. Isaacson is a CPA, they added language that seems to enhance Isaacson’s prestige:

Given SHARE’s reputation, it seems odd that Mr. Agmata would have taken their claim about Isaacson being a CPA at face value, especially since it is Mr. Agmata’s job to be skeptical. And since it takes only a minute to check this online. It makes one wonder: What else does HSD take on faith?

Wait! Something might be rotten in Denmark

In 2014, the WA State Auditor’s office audited Seattle’s management of federal grant money. These grants include money that was earmarked for homeless programs. The audit found “deficiencies in the design or operation of internal control over financial reporting” that they considered to be “significant.” Below is an extract of the Auditor’s report:

WA_State_Auditor_2013_Single_Audit_Report_Extract

Although the audit focused on administration of federal funds, one could reasonably infer that if there were “significant deficiencies” in the management of federal money, the deficiencies would have applied to all other funds under HSD’s control as well. Also note that SHARE has received Federal Emergency Management Agency (FEMA) funds money at various times, and that is federal money.

See the Auditor’s complete report on the City of Seattle here.

Good post, keep

Could you provide a summary with references to the source? I just want to know what ends up with the SCC. Steam is coming out of my ears!